Estimated Time to Read: 8 minutes

Texans have long voiced concerns over the state’s property tax system, which many argue is both burdensome and ineffective. Despite recent legislative attempts to address this issue, widespread dissatisfaction remains and the burden on many taxpayers continues to grow.

So what are the shortcomings of current efforts and what are real solutions to address them?

The Failures of Recent Property Tax Relief Efforts

Over the past decade, the Texas Legislature has implemented several measures claiming to deliver substantial property tax relief and to reform the overall property tax process. Governor Greg Abbott (R), Lieutenant Governor Dan Patrick (R), and the current House Speaker Dade Phelan (R) have all praised these efforts, branding them as the largest tax cuts in Texas history and providing Texas taxpayers with historic reforms. Yet, despite the fanfare, the data reveals a different reality.

The primary issue is that the state’s mechanisms for property tax reduction focus more on shifting tax burdens rather than cutting them outright. The Legislature’s recent actions provided no genuine relief because while tax rates were adjusted, the overall amount Texans pay continued to climb, largely due to rising property values and local taxing entities’ ability to manipulate revenue caps. Vance Ginn, Ph.D., an economist under the Trump Administration and Texas Policy Research board member, summarizes the issue in his written testimony submitted for the upcoming House Committee on Ways and Means hearing on the subject:

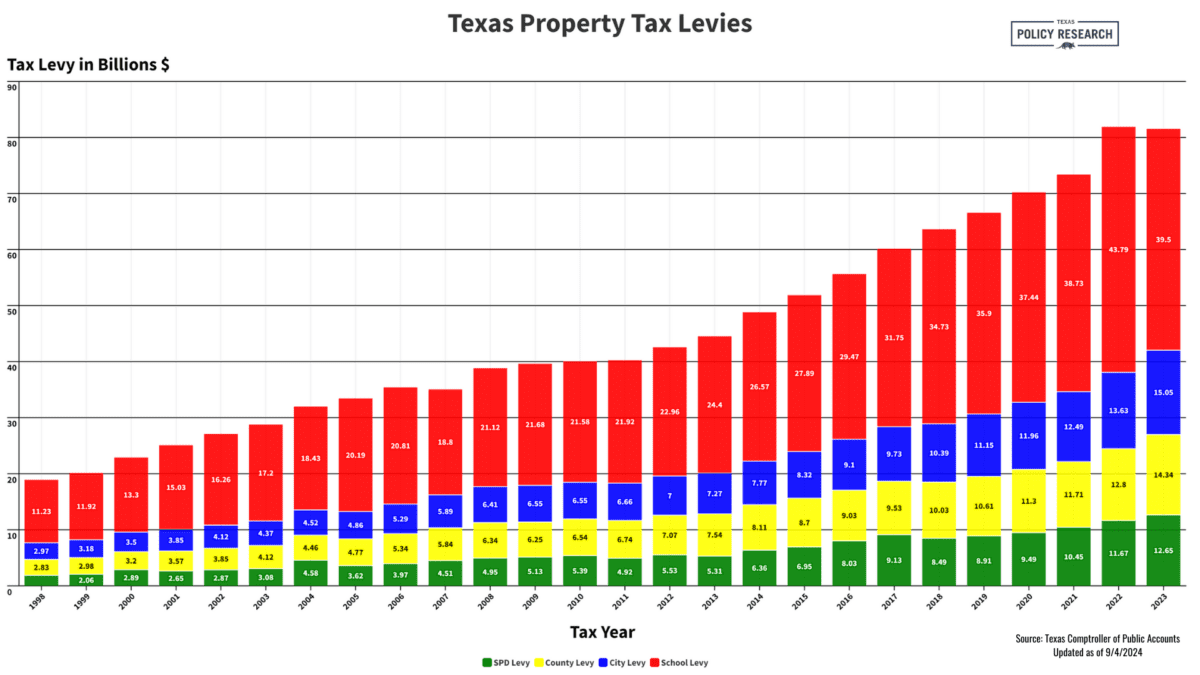

“Rather than allocating all $12.7 billion to reduce school district M&O property tax rates to help everyone with a homestead, rental, or business property, the Legislature chose to pick winners as those with a homestead and losers as those without. In addition to the fact that school districts and other local governments increased spending and taxes excessively, total property taxes levied across the state may have declined slightly by -0.42%. This is the second-best relief since 1998, after a decline of 1.03% in 2007.”

Property Tax levies in Texas between 1998 and 2023, updated as of September 4, 2024

Why the Legislature’s Approach Isn’t Working

The central problem lies in both the Texas Legislature’s and local government’s spending habits. Rather than returning surplus revenues to Texans in the form of meaningful tax cuts, lawmakers prefer to spend the extra funds, growing the size of the government. Between 2021 and 2023, Texas’s appropriations ballooned, but only $12.7 billion of that was directed toward property tax relief. As Dr. Ginn describes, “While about $6.4 billion of the $12.7 billion was allocated to accomplish this relief, the other $6.3 billion is reserved to maintain the relief in the next fiscal year.” Add to that the reality that all across the state of Texas local governmental jurisdictions are passing inflated budgets, and many are using the “disaster loophole” to pass property tax increases without having to go to the voters for their approval.

This disconnect between legislative rhetoric and reality highlights the core issue: politicians are reluctant to curtail spending. As a result, even when tax “relief” packages are passed, they fail to provide the long-term reductions in taxpayer burdens that are so sorely needed.

Key Proposals for Sustainable Relief

Several actionable solutions exist to address these systemic problems. These solutions revolve around limiting government growth, ensuring stricter controls on local taxing entities, and freezing certain tax levies. The following are some of the key recommendations:

- Freeze School Maintenance and Operations (M&O) Property Tax Levies: School M&O taxes make up a significant portion of property tax bills. By freezing these levies, the Legislature could prevent them from continuing to grow unchecked.

- Eliminate Local Taxing Entity Loopholes: Many local governments have found ways to circumvent the “no-new-revenue” tax rate. Stricter enforcement of this rule, along with the elimination of these loopholes, could help ensure that property taxes do not increase year after year without voter approval.

- Strengthen the No-New-Revenue Rate: Under current law, the no-new-revenue tax rate is a rate that allows taxing entities to generate the same revenue as the previous year, taking into account rising property values. However, taxing entities can still increase revenues without voter approval. By making this rule stricter—requiring voter approval for any revenue increase—local governments would be forced to limit their spending or justify it to taxpayers directly.

- Buy Down M&O Taxes with State Surplus: Using 90% of the state’s surplus funds to buy down school M&O taxes would be a significant step toward reducing Texans’ overall property tax burden. Over time, this could allow the state to compress the M&O tax rate to zero, effectively eliminating one of the most significant components of the property tax system.

- Limit State Spending Growth to 2% Annually: One of the fundamental reasons property tax relief efforts have failed is the state’s ballooning budget. By capping spending growth at 2% per year, the state could ensure that a greater portion of surplus funds are directed toward tax relief, rather than being absorbed by new government programs or expenses.

Why These Solutions Matter

True property tax relief will only come when the state commits to reigning in government spending at both the state and local levels. Texas is in a strong fiscal position, with consistent budget surpluses, but unless the Legislature adopts a more fiscally conservative approach, property owners will continue to see their taxes rise.

The proposals to freeze M&O levies, eliminate loopholes, and use surplus funds for tax relief offer a clear roadmap for sustainable reform. Moreover, the recommendation to cap state spending growth provides a long-term solution to prevent future legislatures from reversing any progress made on tax relief. Similar spending caps should be imposed on local governments.

These changes, if implemented, could transform the Texas property tax landscape, providing homeowners with real, lasting relief while ensuring that local governments remain accountable to their taxpayers.

Upcoming Legislative Meeting

A joint meeting between the House Committee on Ways and Means and the House Select Study Committee on Sustainable Property Tax Relief is scheduled for Thursday, September 26. Several topics related to property tax are expected to be considered:

- Reviewing the impact of HJR 2/SB 2 (passed during the second special legislative session of the 88th Legislature), which provides property tax relief through various mechanisms, on achieving the goal of providing sustainable property tax relief for Texas property owners.

- Evaluate the effects of tax rate compression, limits on taxable value, and homestead exemption increases to maximize savings to property owners, and evaluate whether Texas’ economic performance and state tax revenues support further compression of school district tax rates.

- Study the viability and sustainability of eliminating maintenance and operations taxes by 2035.

- Examine historical rates of appraisal increases, and methods to reduce the tax burden of appraisal increases on all real property. Evaluate whether to extend the limitation on the appraised value of certain non-homestead real property past the current expiration date of December 31, 2026, and whether to further reduce the limit on the appraised value of homesteads.

- Examine the long-term value of homestead exemptions to Texas homeowners in conjunction with the impact of appraisal increases and evaluate whether to maintain the homestead exemption at its current rate.

As lawmakers approach the 89th Legislative Session, set to begin in January 2025, yet another historic opportunity exists to truly address the ever-growing property tax burden on Texas taxpayers head-on. Lawmakers can truly set taxpayers on a path to eliminating the tax altogether if they take the steps necessary to ensure taxpayer’s future prosperity, which includes addressing spending.

Conclusion

Texas’ property tax system has long been a source of frustration for its residents. Despite recent legislative claims of providing the largest tax cuts in state history, the burden on taxpayers continues to grow. The realities highlight the need for more substantive, structural reforms. By freezing school M&O levies, closing loopholes, and directing surplus funds toward tax relief, Texas can ease the ever-increasing burden on Texas taxpayers. However, such change will only be possible if the state also addresses its spending habits, ensuring that surplus funds are used for the benefit of taxpayers, rather than for expanding government.

Texas has a choice: continue on its current path of growing government and rising taxes, or embrace the kind of bold reforms that will provide real relief to property owners across the state. The path forward is clear—now it’s up to the Legislature to act.

Texas Policy Research relies on the support of generous donors across Texas.

If you found this information helpful, please consider supporting our efforts! Thank you!