Estimated Time to Read: 2 minutes

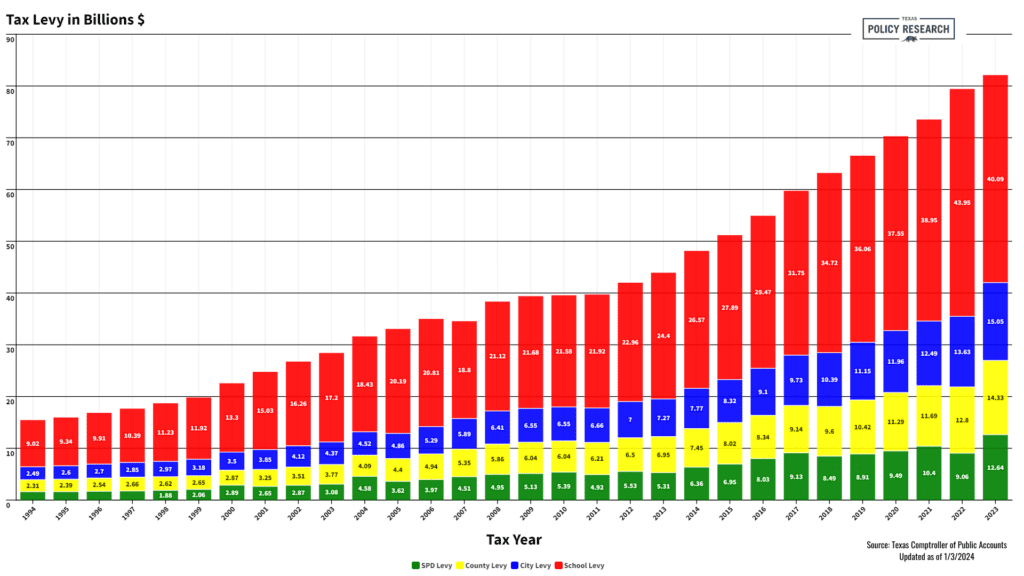

In the heart of the Lone Star State, a pressing issue has been quietly intensifying: the increasing property tax levies. A recent data project, spanning from 1994 to 2023, sheds light on this escalating burden, challenging the narrative of tax relief efforts by the Texas Legislature.

The data encompasses tax levies from Special Purpose Districts, Cities, Counties, and School Districts. This comprehensive scope offers a revealing glimpse into the complex tapestry of Texas’s property tax system. What emerges is a story of persistent growth in tax levies, despite legislative attempts to ease this financial strain on Texans.

Over the years, the legislature has rolled out numerous measures aimed at providing property tax relief. However, these efforts often resembled more of a band-aid solution rather than a fundamental reform. The data clearly illustrates this disconnect: tax levies have only surged upwards, with no signs of a significant downturn.

School Districts, for instance, represent a critical component of this narrative. Despite legislative attempts to reform school funding and alleviate property tax pressures, these districts have broadly and consistently imposed higher tax burdens on taxpayers. Similarly, the growth in levies from Cities, Counties, and Special Purpose Districts further compounds the issue, painting a picture of a system that favors increases in spending thereby necessitating tax increases.

This trend is more than just numbers; it translates to a tangible impact on the residents of Texas. The burden of rising property taxes affects homeowners and renters alike, reshaping the economic landscape of communities and influencing decisions on home ownership and investment.

In conclusion, the data project not only highlights the mounting property tax levies in Texas but also underscores the complexity and challenges of achieving meaningful tax relief. It’s a wake-up call for policymakers and citizens alike to engage in a more nuanced and effective dialogue about tax reform in Texas. As we move forward, it’s crucial that these discussions are grounded in data and driven by a commitment to finding sustainable solutions for all Texans.

To view all of the data go here.

For the raw data as provided by the Texas Comptroller go here.

Texas Policy Research relies on the support of generous donors across Texas. If you found this information helpful, please consider supporting our efforts! Thank you!