Estimated Time to Read: 10 minutes

School choice programs have become a central issue in education policy debates across the United States. Advocates argue that these programs provide parents with more educational options for their children, while also generating taxpayer savings by reducing the financial burden on public school systems. Critics, however, worry that such programs divert vital resources from public schools, potentially undermining their quality. To assess the true financial impact of these programs, EdChoice conducted a comprehensive analysis in its report, Fiscal Effects of School Choice. After reviewing the report, we have identified its key takeaways and explored how these insights could be applied to Texas, a state currently evaluating the merits of school choice.

Key Findings from the EdChoice Report

The EdChoice report analyzes 48 private school choice programs across 25 states and Washington, D.C. These programs include education savings accounts (ESAs), school vouchers, and tax-credit scholarships. The programs reviewed have been in place for at least five years, offering enough data to evaluate their long-term fiscal effects. The report reveals that school choice programs have saved state and local taxpayers between $19.4 billion and $45.6 billion through fiscal year (FY) 2022. This equates to a savings of approximately $3,300 to $7,800 per student participating in the program. The savings arise because many of the students in these programs would have otherwise attended public schools, which are generally more expensive on a per-pupil basis. Therefore, for each dollar spent on school choice programs, taxpayers see an average return of $1.70 to $2.64 in savings.

These programs show that providing parents with more educational options does not just improve access to quality education but also results in significant financial benefits for states. The report suggests that these savings stem from lower public education costs, as fewer students require public school funding, freeing up state and local resources for other purposes.

Long-Term vs. Short-Term Fiscal Effects

One of the key distinctions made in the report is between short-term and long-term fiscal effects. When a school choice program is first implemented, the immediate savings may be smaller because of lower participation rates and start-up costs. However, as these programs expand and more families choose private options, the long-term fiscal benefits become more apparent. The report notes that over time, the cumulative savings from these programs are likely closer to the upper bound of $45.6 billion, as opposed to the lower estimate of $19.4 billion. This means that the longer these programs are allowed to operate and grow, the greater the potential fiscal impact.

The fiscal success of school choice programs also depends heavily on what is known as the “switcher rate.” This refers to the percentage of students participating in a school choice program who would have attended public school in the absence of such an option. The report calculates that, on average, if 57% of students are switchers, the program generates fiscal savings. In states where these programs have been established for many years, the break-even switcher rate can be as low as 36%, demonstrating that even moderate participation can lead to financial benefits. Notably, studies suggest that the actual switcher rate tends to be much higher—between 85% and 90%—which implies that most programs produce substantial fiscal savings for state and local governments.

The long-term perspective is critical for policymakers evaluating the viability of school choice. Although initial implementation may present challenges and upfront costs, the eventual fiscal and educational outcomes are often much more favorable.

Funding Disparities Between School Choice and Public Schools

One of the most significant findings of the EdChoice report is the substantial gap in funding between public school students and those participating in school choice programs. On average, students in school choice programs receive just 36% of the per-pupil funding allocated to their public school peers. In other words, for every dollar spent on a public school student, only 36 cents are spent on a student in a school choice program. Despite this discrepancy, school choice programs still manage to deliver fiscal savings, highlighting their efficiency.

This funding disparity is especially pronounced in programs like tax-credit scholarships and school vouchers, where private funding is supplemented by tax incentives rather than direct public spending. Education savings accounts (ESAs), which are often used to support students with special needs, tend to receive a slightly higher share of public funding—about 44% of the amount provided to public school students. In 18 of the 26 states analyzed, students in school choice programs receive less than one-third of the revenue that public schools would have generated for their attendance.

This disparity, while challenging for some critics to accept, underscores how school choice programs can operate at a lower cost per student while still providing access to quality education. In fact, many of these programs continue to expand, benefiting students and parents while reducing financial strain on public school systems. For Texas, where education funding is a contentious issue, these findings offer a pathway to more efficient use of taxpayer funds while still maintaining educational quality.

The Arizona Case Study: A Look at Long-Term Savings

A particularly illuminating example in the report is Arizona’s Empowerment Scholarship Accounts (ESA) program, which became universal in FY 2023. Initially, the program produced a short-term net fiscal cost of $37 million in FY 2024. However, over the long term, Arizona’s ESA program is projected to generate annual savings of $244 million. This case study illustrates how new programs may incur initial costs but lead to significant savings as they expand and more students switch from public to private education.

Critics of school choice often argue that such programs “drain” public education funding, but the Arizona example shows that, with time and proper implementation, these programs can produce net financial gains. The key lies in understanding the time horizon of these effects. States like Arizona, with a long history of school choice, demonstrate that early investments in these programs yield substantial returns in the long run.

Implications for Texas

While Texas is not yet a prominent player in the school choice landscape, the findings from the EdChoice report offer valuable insights for policymakers considering the adoption of such programs. Texas, which has a large and diverse student population, could see significant financial benefits from school choice initiatives, particularly if they are tailored to meet the state’s unique needs. With proper design, Texas could experience the same long-term savings as states like Arizona and Florida, where school choice programs have been in place for years and have produced measurable fiscal benefits.

Implementing school choice programs in Texas could alleviate some of the financial pressure on the state’s public school system by shifting a portion of students to private educational programs. However, as the Arizona case shows, the state must be prepared for potential short-term costs during the initial phase of implementation. Over time, as more students participate, the fiscal benefits could offset these early expenditures, resulting in significant savings for the state.

Polling already shows significant public support for School Choice in Texas. Republicans have held all statewide elected offices and a majority in both chambers of the Texas Legislature for over two decades. Their own 2024 Republican Party of Texas Platform includes strong support for school choice:

84. School Choice: We support further empowering all Texas families to choose from public, private, charter, or homeschool options for their children’s education and funding which shall follow the student with no strings attached. We oppose regulations on homeschooling or the curriculum of private or religious schools and believe a constitutional amendment should be adopted accordingly. In lieu of funding, citizens may use property tax exemptions.

2024 Republican Party of Texas Platform

The use of Education Savings Accounts (ESAs) was at the heart of contention in the last legislative cycle. Prioritized by Gov. Greg Abbott in his State of the State Address in February 2023 as an “Emergency Item,” ESAs were subsequently considered in a special legislative session and used as a factor in primary elections via endorsements of particular candidates. ESAs were undoubtedly a determinant factor in what will be the new legislative disposition in the next legislative session (2025), as arguably 9 incumbent state lawmakers chose not to run for re-election over the issue, and 15 incumbent state representatives lost their primary elections.

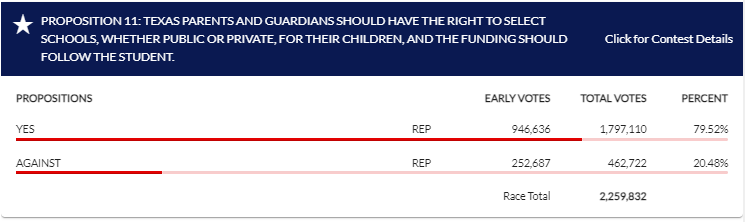

The subject has also been included in recent Republican Primary Elections. In 2024, Republican primary voters considered Proposition 11:

Proposition 11: Texas parents and guardians should have the right to select schools, whether public or private, for their children, and the funding should follow the student.

Ballot Proposition, March 2024 Republican Primary Election

Proposition 11 passed overwhelmingly by Republican primary voters with 79.52% (1,797,110 votes) in favor and 20.48% (462,722 votes) in opposition.

Opportunities for Special Needs Students and Funding Reform

Texas has a growing population of students with special needs, and expanding school choice programs—particularly ESAs—could provide better educational options for these students. By allowing families to tailor educational services to meet individual needs, ESAs offer a flexible and more personalized approach. Additionally, since ESAs often receive a higher share of public funding compared to other school choice programs, they ensure that special needs students are not left behind in the funding gap that exists between public schools and school choice programs.

Furthermore, school choice programs could play a role in addressing the existing funding inequities within Texas’ public school system. By enabling some students to attend private schools with reduced public funding, Texas could redirect resources to underserved public schools, creating a more balanced and efficient education funding system overall. This approach not only supports students who participate in school choice programs but also benefits the broader public school population.

Conclusion

The EdChoice report makes a compelling case for the fiscal benefits of school choice programs. Over time, these programs have demonstrated that they can generate significant savings for state and local taxpayers while providing families with more educational options. For Texas, adopting such programs could lead to billions in potential savings, improved support for special needs students, and a more equitable allocation of educational resources. As the state continues to evaluate its education system, school choice offers a promising avenue for reform that balances fiscal responsibility with educational freedom.

In conclusion, Texas stands at a crossroads when it comes to education policy. By learning from the experiences of other states, particularly those with well-established school choice programs, Texas can design a system that serves the needs of its students while ensuring responsible stewardship of taxpayer funds. School choice programs not only empower parents but also create a more flexible, efficient, and financially sustainable education system for the future.

Texas Policy Research relies on the support of generous donors across Texas.

If you found this information helpful, please consider supporting our efforts! Thank you!