Estimated Time to Read: 4 minutes

Ahead of the 89th Legislative Session, Texas Comptroller Glenn Hegar (R) released the Biennial Revenue Estimate (BRE) for the 2026-2027 biennium. This pivotal document outlines the state’s projected financial resources, economic outlook, and fiscal policy implications, providing essential insights for the 89th Texas Legislature, which gets underway starting Tuesday, January 14th, 2025.

What is the Biennial Revenue Estimate?

The Biennial Revenue Estimate (BRE) is what forms the basis of the Texas state budget for the upcoming biennium (next two fiscal years). At the beginning of each regular legislative session, the Texas Constitution requires the Texas Comptroller of Public Accounts to submit a statement showing the state’s financial condition and estimating the revenue it can expect to receive during the next two-year budget period.

Where the BRE falls in the overall budget process can be seen here.

Source: Texas Comptroller, 1.13.2025

Major Takeaways

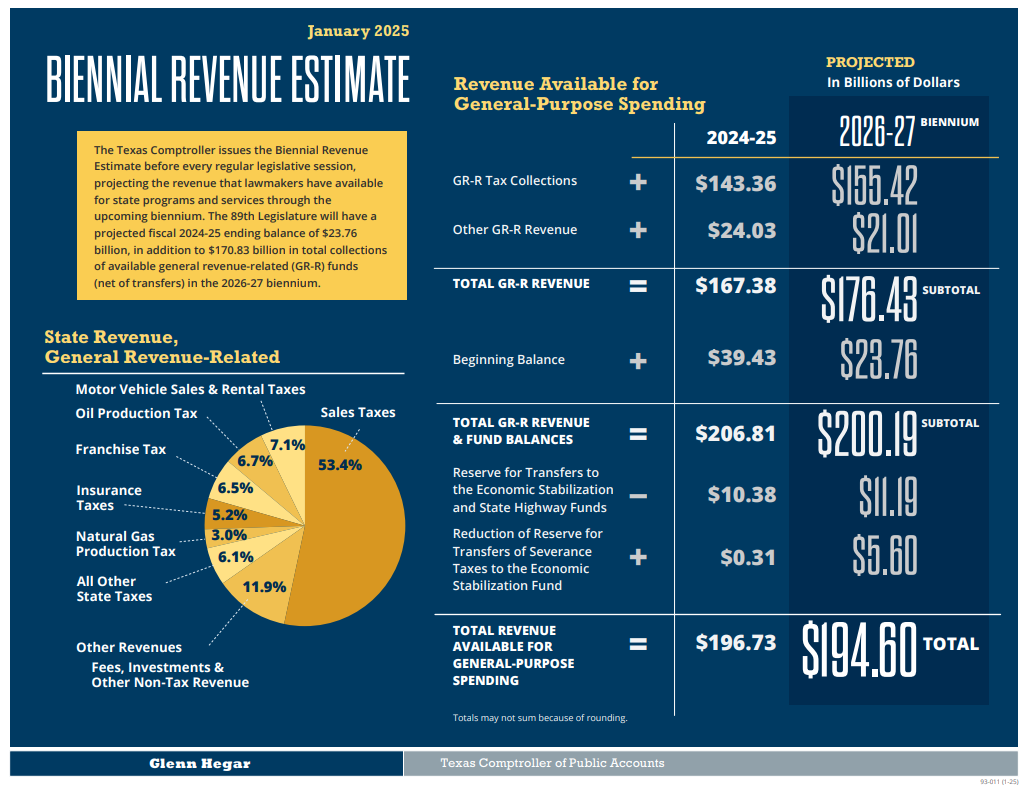

The BRE forecasts $194.6 billion in general-purpose spending for the 2026-2027 biennium, a slight decrease (1.1%) from 2024-2025. This reduction stems from a lower beginning balance, despite projected increases in tax and non-tax revenue collections. General Revenue-Related (GR-R) Funds are projected to total $176.4 billion, primarily from sales taxes, which account for 61% of GR-R tax revenue, along with motor vehicle sales taxes and oil and natural gas production taxes. In addition, Texas anticipates $115 billion in federal income, further bolstered by $70.7 billion in dedicated revenues earmarked for specific purposes.

Projected Tax Revenue Growth and Economic Stability in Texas

The state’s tax system underpins its financial stability, with tax collections expected to increase by 8.4% from the previous biennium to reach $155.4 billion. Sales tax, projected at $94.2 billion, reflects strong consumer and business activity. Franchise tax revenues are estimated at $11.5 billion, showcasing robust business performance despite structural tax changes. Oil and gas taxes provide additional stability, with oil production tax revenues expected to remain steady while natural gas production taxes surge by 25.5% due to rising demand and increased prices.

Texas’ Economic Outlook for the 2026-27 Biennium

Texas’ economic performance remains a beacon of resilience, albeit with slower growth rates than in recent years. The Gross State Product (GSP) is expected to grow by 2.5% annually, reaching $3.06 trillion in 2027. Nonfarm employment is forecasted to rise modestly by 0.9% annually, while the population is set to grow at 1.2% annually, significantly outpacing the national average. The state’s favorable business climate, coupled with moderate inflation and declining interest rates, provides a stable foundation for continued economic expansion.

Budget Surplus

The projected starting balance for the 2026-2027 biennium benefits significantly from the surplus carried over from the previous budget cycle. The ending balance of $23.76 billion in 2024-2025, bolstered by unspent appropriations and federal substitutions for general revenue, positions Texas with a strong financial foundation. Notably, $4.5 billion in contingent appropriations for education savings accounts and $6.6 billion saved by substituting federal COVID-related funds for criminal justice spending contribute to this surplus. This robust fiscal health highlights yet another historic opportunity for the Texas Legislature to provide not only substantial property tax relief to Texas taxpayers but also a pathway to the elimination of the tax altogether.

Focus on the Economic Stabilization Fund (Rainy Day Fund)

The Economic Stabilization Fund (ESF), commonly referred to as the Rainy Day Fund, plays a critical role in Texas’ fiscal resilience. For the 2026-2027 biennium, the ESF balance is projected to reach $28.5 billion, exceeding its constitutional cap. This surplus prevents additional transfers into the fund during this period, allowing the state to retain revenues that would otherwise be allocated to the ESF. The fund’s robust balance is something that Texas lawmakers will all but assuredly have to address in the coming legislative session.

Major Fiscal Policies in the Texas Biennial Revenue Estimate

Several fiscal policies will shape the allocation of funds over the biennium. The State Highway Fund (SHF) will receive $5.6 billion reserved from oil and gas tax collections for transportation infrastructure. The Economic Stabilization Fund (ESF) will not see transfers in 2026-2027 as its balance will exceed its constitutional cap, reaching $28.5 billion by the end of the biennium. Significant unspent appropriations from the 2024-2025 biennium, including $4.5 billion for education savings accounts, contribute to the projected starting balance.

Challenges to Texas’ Revenue and Economic Forecasts

The BRE emphasizes potential risks that could disrupt projections. Volatile oil and gas prices remain a critical concern. Global geopolitical tensions, weather-related disasters, and changes in federal policies also pose significant uncertainties. Economic challenges, such as inflationary pressures and Federal Reserve policy shifts, could further impact the state’s fiscal landscape. In a statement, Comptroller Hegar said,

“Potential economic disruption could come from weather-related disasters, the continued wars in Ukraine and the Middle East, China’s economic activities, changes in federal policies, and the possibility that the Federal Reserve must continue restrictive monetary policy efforts to combat resurgent inflation. And the only certainty with regard to oil and gas prices is that they are volatile. Absent an economic crisis, however, I project our economy will continue to grow at a rate consistent with historical norms following the profound disruption of the pandemic, the dramatic recovery when COVID restrictions were lifted and the high inflation that accompanied booming economic growth.”

Source: Press Release, Texas Comproller, 1.13.2025

Dr. Vance Ginn, a TPR board member, and President of Ginn Economic Consulting, shared his thoughts on the BRE via Twitter/X:

“Given the projected decline in GR available for the 2026-27 budget, I recommend the Legislature CUT spending where possible. Savings can replace the arcane school finance system with universal ESAs, reform Medicaid, eliminate corporate welfare, and other efforts.”

“The ESF fund has nearly $30 billion in it and exceeds the cap. Oil and gas producers are paying severance taxes to contribute to that fund, which makes them less competitive with the green energy agenda. Therefore, I recommend the Legislature cut severance taes and reduce the constitutional cap to at least 7% per biennium.”

“Surplus should be used to return to taxpayers, mainly through reducing school district M&O property tax rates to put them on a path to elimination.”Source: Twitter/X Post by Dr. Vance Ginn, 1.13.2025

Conclusion

The 2026-2027 Biennial Revenue Estimate reflects Texas’ robust fiscal position and economic potential. However, it also underscores the importance of prudent policymaking to navigate uncertainties, provide substantial tax relief, and maximize opportunities for growth. As the 89th Texas Legislature convenes, this report will serve as a critical resource in shaping the state’s financial future.

Texas Policy Research relies on the support of generous donors across Texas.

If you found this information helpful, please consider supporting our efforts! Thank you!