Estimated Time to Read: 5 minutes

*This post was updated to reflect a tax increase, originally listed as a tax decrease, for Dallas County

With Texas continuing to experience rapid population growth, the impact on local economies, infrastructure, and public services is profound. However, one area that has become an increasing concern for residents is property taxes. As millions of Texans grapple with rising home values and the potential for even higher taxes, the question of whether the state’s property tax relief efforts are enough looms larger than ever. In this analysis, we break down the property tax landscape for Texas’ most populous counties and cities to see how many residents are facing tax hikes, and what that means for the future of tax relief in the state.

Texas has an overall population of 30.03 million people, making it the second most populous state in the United States. Nearly 70 percent of those people live in just 15 counties of Texas’ total 254 counties. About 34 percent of those same Texans live in just 15 cities of the total 1,225 municipalities across Texas.

Top 15 Most Populous Counties

Nearly 21 million Texans live in the top 15 most populous counties. Of these, seven counties are raising property taxes, while five are providing tax cuts. Four counties have kept their tax rates unchanged, but with rising home values and the possibility of voter-approved bond propositions in the upcoming November election, residents in these areas could still face higher taxes. To put it in perspective, nearly 36% (10,785,192) of Texans in these counties will experience a property tax increase, a figure that could rise to 44% (13,253,931) depending on home value growth and the passage of bond measures.

Table 1. Top-15 Most Populous Texas Counties

| Rank | County | Population | % of Texas Population | Tax Proposal Result |

|---|---|---|---|---|

| 1 | Harris | 4,986,621 | 16.61% | Tax Increase |

| 2 | Dallas | 2,636,564 | 8.78% | Tax Increase |

| 3 | Tarrant | 2,231,284 | 7.43% | Tax Decrease |

| 4 | Bexar | 2,127,144 | 7.08% | No Change to Tax Rate* |

| 5 | Travis | 1,396,556 | 4.65% | Tax Increase |

| 6 | Collin | 1,177,313 | 3.92% | No Change to Tax Rate* |

| 7 | Denton | 1,003,946 | 3.34% | Tax Decrease |

| 8 | Fort Bend | 917,739 | 3.06% | Tax Decrease |

| 9 | Hidalgo | 909,185 | 3.03% | No Change to Tax Rate* |

| 10 | El Paso | 891,661 | 2.97% | No Change to Tax Rate* |

| 11 | Montgomery | 686,323 | 2.29% | Tax Increase |

| 12 | Williamson | 683,553 | 2.28% | Tax Increase |

| 13 | Cameron | 426,937 | 1.42% | Tax Decrease |

| 14 | Brazoria | 395,575 | 1.32% | Tax Increase |

| 15 | Bell | 394,811 | 1.31% | Tax Increase |

| 20,865,212 | 69.49% |

*Due to rising home valuations and the potential for additional bond obligations counties that adopted no change to their tax rates could still see a result of a tax increase.

Top 15 Most Populous Cities

Nearly 10.2 million Texans reside in the top 15 most populous municipalities. Of these cities, six are raising property taxes, while three are providing tax cuts. Six cities have kept their tax rates unchanged, but with rising home values and potential voter-approved bond propositions in the November election, residents in these municipalities could still see tax increases. To put it in perspective, 8.36% (2,509,578) of Texans in these cities will face a property tax hike, and that number could rise to 28.23% (8,474,299) depending on home value increases and successful bond measures.

Table 2. Top-15 Most Populous Texas Cities

| Rank | City | Population | % of Texas Population | Tax Proposal Result |

|---|---|---|---|---|

| 1 | Houston | 2,314,157 | 7.71% | No Change to Tax Rate* |

| 2 | San Antonio | 1,495,295 | 4.98% | No Change to Tax Rate* |

| 3 | Dallas | 1,302,868 | 4.34% | Tax Decrease |

| 4 | Austin | 979,882 | 3.26% | Tax Increase |

| 5 | Fort Worth | 978,468 | 3.26% | No Change to Tax Rate* |

| 6 | El Paso | 678,958 | 2.26% | No Change to Tax Rate* |

| 7 | Arlington | 398,431 | 1.33% | Tax Increase |

| 8 | Corpus Christi | 316,595 | 1.05% | Tax Increase |

| 9 | Plano | 290,190 | 0.97% | Tax Increase |

| 10 | Lubbock | 266,878 | 0.89% | Tax Increase |

| 11 | Laredo | 257,602 | 0.86% | Tax Increase |

| 12 | Irving | 254,373 | 0.85% | No Change to Tax Rate* |

| 13 | Garland | 243,470 | 0.81% | No Change to Tax Rate* |

| 14 | Frisco | 225,007 | 0.75% | Tax Decrease |

| 15 | McKinney | 213,509 | 0.71% | Tax Decrease |

| 10,215,683 | 34.03% |

*Due to rising home valuations and the potential for additional bond obligations counties that adopted no change to their tax rates could still see a result of a tax increase.

Property Tax Relief Efforts

If anything, the mixed results of the data presented above show yet another reason why Texas’ property tax relief efforts have not been the most effective. We recently highlighted where those efforts have fallen short and what state lawmakers can do to ensure the tax relief they provide actually does lessen the property tax burden on Texas taxpayers.

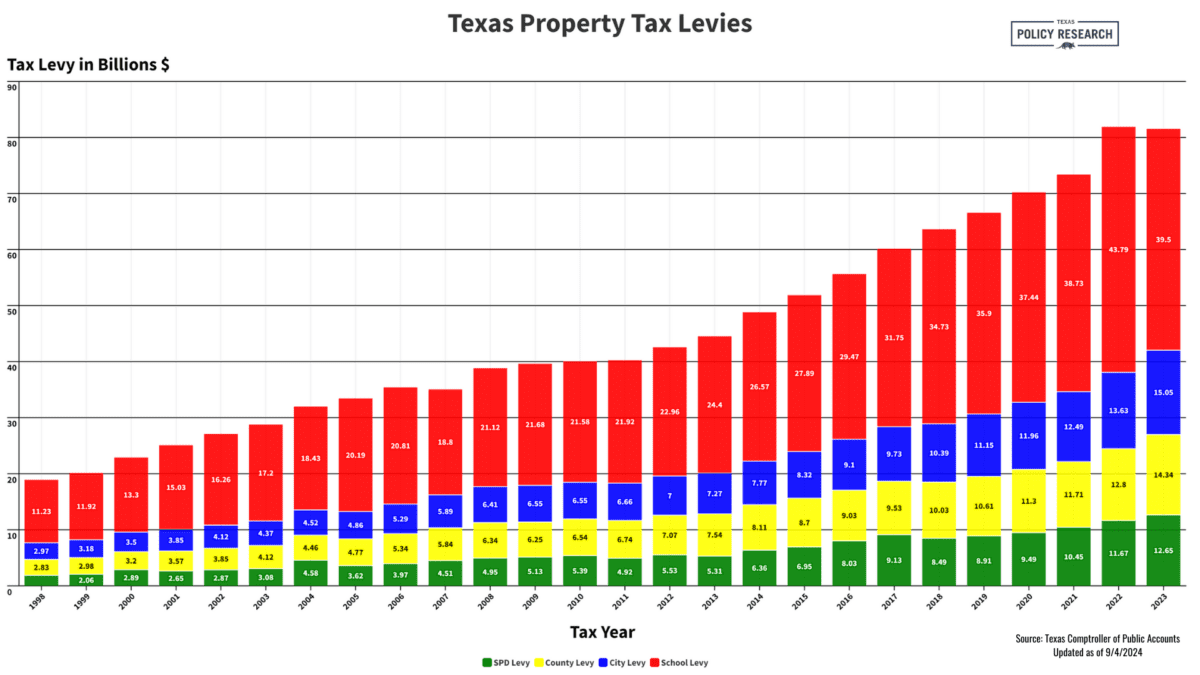

Property Tax levies in Texas between 1998 and 2023, updated as of September 4, 2024

True property tax relief will only come when the state commits to reigning in government spending at both the state and local levels. Texas is in a strong fiscal position, with consistent budget surpluses, but unless the Legislature adopts a more fiscally conservative approach, property owners will continue to see their taxes rise.

The proposals to freeze M&O levies, eliminate loopholes, and use surplus funds for tax relief offer a clear roadmap for sustainable reform. Moreover, the recommendation to cap state spending growth provides a long-term solution to prevent future legislatures from reversing any progress made on tax relief. Similar spending caps should be imposed on local governments.

These changes, if implemented, could transform the Texas property tax landscape, providing homeowners with real, lasting relief while ensuring that local governments remain accountable to their taxpayers.

Conclusion

While Texas’ economy remains strong and the state continues to attract new residents, the mixed property tax landscape across its counties and cities paints a concerning picture. As local governments either raise taxes or hold them steady despite rising home values, many Texans may see their property tax burdens grow in the coming years. True relief will only come from meaningful reforms that limit government spending at all levels and prevent future tax hikes. By adopting more aggressive measures like capping spending and closing loopholes, Texas lawmakers have the opportunity to create lasting tax relief that genuinely benefits homeowners and ensures long-term accountability. Without such reforms, Texans may find themselves trapped in a cycle of rising taxes, even in times of budget surpluses.

Texas Policy Research relies on the support of generous donors across Texas.

If you found this information helpful, please consider supporting our efforts! Thank you!