Estimated Time to Read: 7 minutes

On Wednesday, the Texas Senate Finance Committee held a public hearing to discuss various budgetary issues, including the potential elimination of property taxes—a topic that has ignited heated debates among lawmakers, experts, and Texans alike. During the hearing, experts provided testimony, lawmakers explored potential implications, and various options were considered for replacing the revenue currently generated by property taxes.

The hearing, which lasted approximately three and a half hours, was held in response to Interim Charges issued by Lieutenant Governor Dan Patrick (R) in early April 2024. Specifically, the committee was tasked with preparing a report on the cost of eliminating:

- School maintenance and operation property taxes

- All school property taxes; and

- All property taxes

Brief Background: The Property Tax Debate

Texas has long relied on property taxes to fund local governments, government education, and other essential services. However, property taxes in Texas are often criticized for being burdensome and unpredictable, with rising rates causing concern among homeowners and businesses. The debate over eliminating property taxes is rooted in these concerns, with proponents advocating for a government that spends less and a more predictable, equitable tax system.

State lawmakers have attempted to address the growing burden of property taxes in numerous ways, especially over the last few legislative sessions. These efforts have included reforms to the appraisal process, changes in how taxes are levied, and the compression of the school maintenance and operations (M&O) tax rate using state taxpayer funds. While some efforts have had modest success for specific property taxpayers, the overall tax burden continues to stifle prosperity for many Texas families and businesses.

A Call for Economic Freedom

During the hearing, Dr. Vance Ginn, an economist, President of Ginn Economic Consulting, and Texas Policy Research board member, delivered testimony strongly advocating for the elimination of property taxes. According to Ginn, property taxes infringe on private property rights and create economic inefficiencies that hinder growth. He argued that property owners should have more certainty and control over their assets, free from the burden of unpredictable taxation.

Ginn proposed that eliminating property taxes could provide economic freedom and lead to more prosperous outcomes for Texans. He outlined a plan to phase out property taxes over several years gradually and encouraged spending restraint, an expanded sales tax base, and other consumption-based taxes. This approach, he argued, would b promote economic growth by leaving more money in Texans’ pockets.

At Texas Policy Research, we strongly believe that property taxation is immoral and will support legislation that truly protects private property rights and homeownership whenever it is considered by the Texas Legislature.

Can Texas Afford to Eliminate Property Taxes?

Representatives from the Legislative Budget Board testified that eliminating property taxes collected by school districts would have cost the state $39.5 billion in the 2023 tax year. To offset the property taxes collected by cities, counties, and special purpose districts, the state would need to allocate an additional $42 billion. In total, fully eliminating local property taxes would cost $81.5 billion.

Throughout the hearing, lawmakers expressed concerns about the feasibility of such a move. To fully compensate for the loss of property tax revenue, the state would need to more than double its sales tax rate or significantly broaden the tax base to include currently exempt goods and services—especially since Texas does not have an income tax. This assumption, seemingly accepted by many lawmakers at the hearing, suggests that cutting spending is either a non-starter or considered unthinkable. If this is the case, it is a shame and should be concerning to Texas taxpayers. The truth is, Texas can eliminate property taxes. It will take bold action.

Dr. Ginn emphasized this point in both his testimony and his research published earlier this year in The City Journal:

“In conjunction with a stronger constitutional spending limit, the Texas legislature should implement strategic budget cuts. These efforts combined with the stricter constitutional spending limit would create opportunities for surpluses at the state and local levels, which would pave the way for the state to reduce school M&O property taxes annually until they are fully eliminated. This alone would shave off nearly half of the property tax burden in Texas.”

The Huffines Liberty Foundation has echoed similar sentiments. In their research, they argue that Texas can afford to eliminate property taxes through bold steps that include limiting state spending growth, freezing school M&O property taxes, and requiring local governments to get voter approval to increase property tax revenue—all while keeping schools fully funded.

The Texas Public Policy Foundation has similarly advocated for a path to eliminate property taxes by offering options such as a complete redesign of the tax system or buying down the M&O portion of the tax with surplus state funds.

So, can Texas eliminate property taxes? Yes. Will Texas lawmakers take the bold action necessary? That remains to be seen.

Political Dynamics and Public Opinion

The debate over eliminating property taxes is not just an economic or fiscal issue; it is also highly political. As reported by KXAN, there are deeply entrenched views on both sides. Some conservative lawmakers and advocacy groups support the idea of eliminating property taxes, citing economic freedom and property rights. Meanwhile, other policymakers and community advocates are concerned about the potential impacts on essential services.

Public opinion on the subject, though somewhat divided, is clear among Republicans. The Republican Party has enjoyed majorities in both chambers of the Texas Legislature and every statewide elected office for over two decades.

The 2024 Republican Party of Texas platform specifically states:

75. Ax the Property Tax: We support replacing the property tax system for businesses and individuals with an alternative other than the income tax, and requiring voter approval to increase the overall tax burden. We demand the Legislature to immediately develop and implement a transition plan that is a net tax cut.

In the 2024 Republican Primary Election, Texas Republican voters overwhelmingly supported Ballot Proposition 1, which asked:

Proposition 1: Texas should eliminate all property taxes without increasing Texans’ overall tax burden.

Texas Republican voters passed this proposition with 77.97 percent in favor (1,741,825 votes) and only 22.03 percent opposed (492,231 votes).

Source: Texas Secretary of State

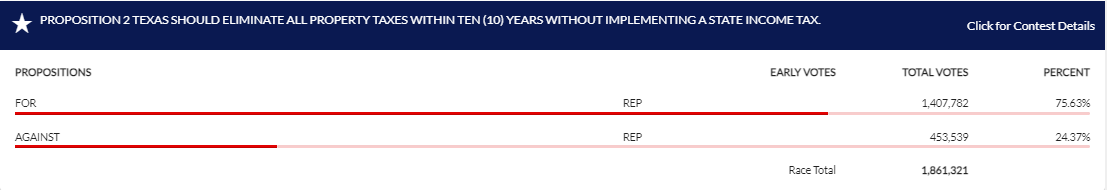

A similar question was posed in the 2022 Republican Primary Election through Proposition 2, which asked:

Proposition 2: Texas should eliminate all property taxes within ten (10) years without implementing a state income tax.

This proposition also passed, with 75.63 percent in favor (1,407,782 votes) and only 24.37 percent opposed (453,539 votes).

Source: Texas Secretary of State

These results indicate that public sentiment is in favor of eliminating the tax. So what is standing in the way? Some argue that it is the industry built up around the tax itself, comprising not only the local governments that levy the tax but also private businesses that specialize in assisting property taxpayers through the process. This includes a variety of services ranging from protesting property tax appraisals to arbitrating legal matters and resolving exemption issues.

Conclusion

The discussion at the Texas Senate Finance Committee hearing highlighted the complexity of the issue of eliminating property taxes. While the idea of property tax elimination appeals to many as a means of achieving economic freedom and reducing the tax burden, the reality is that finding a suitable replacement for such a significant source of revenue presents substantial challenges—especially if responsible and sustainable government spending is not also part of the discussion.

Ultimately, whether Texas can or should eliminate property taxes will depend on lawmakers’ ability to craft a comprehensive and bold strategy to address the issue.

Texas Policy Research relies on the support of generous donors across Texas.

If you found this information helpful, please consider supporting our efforts! Thank you!