Estimated Time to Read: 17 minutes

Casino gambling and sports betting in Texas have been contentious issues for years, consistently drawing debate among state lawmakers, interest groups, and Texans more broadly. As one of the few states with strict restrictions on most forms of gambling, Texas has seen repeated efforts to expand gambling options, with varying degrees of success and failure. In recent legislative cycles, the discourse around these issues has reached a fever pitch, so where do things stand?

Quick-Jump

A Brief History of Gambling in Texas

To understand the current debate, it’s important to review the history of gambling in Texas. Historically, Texas has been resistant to expanding gambling beyond a few regulated forms. The state permits limited gambling options, such as horse and greyhound racing, charitable bingo, and the state lottery. Efforts to expand gambling in the state have frequently faced significant legislative hurdles.

Recent Legislative Efforts

The push for legalized casino gambling in Texas has gained renewed momentum in recent years, driven by the desire to capture potential economic benefits. The most significant effort came during the 88th Legislative Session (2023) when several lawmakers introduced legislation proposing the legalization of casino resorts in designated areas of the state, as well as legislation seeking to allow sports betting.

State Rep. Charlie Geren (R-Fort Worth) introduced House Joint Resolution 155, a constitutional amendment proposal that, if passed, would have allowed the establishment of destination resorts with casinos in specific metropolitan areas like Dallas-Fort Worth, Houston, and San Antonio. Its enabling legislation, authored by State Rep. John Kuempel (R-Seguin), would have established the regulatory framework for such gambling expansion by creating the Texas Gaming Commission and outlining the process for licensing. After several successful amendments, both pieces of legislation passed a second reading in the Texas House of Representatives. However, both were postponed beyond key deadlines before being taken up on the third and final reading, thereby ending their legislative prospects.

It is worth noting that State Sen. Carol Alvarado (D-Houston) authored a similar casino expansion proposal, Senate Joint Resolution 17. Though it was referred to the Senate State Affairs Committee, it never received a public hearing and, as such, was never considered.

Alongside casino gambling, there were also proposals to legalize sports betting. Proponents often linked both issues, arguing that a comprehensive approach to gambling could maximize revenue for the state and attract broader public support.

State Rep. Jeff Leach (R-Allen) authored House Joint Resolution 102 and its enabling legislation, House Bill 1942, which would have proposed a constitutional amendment to legalize certain types of sports betting. The bills stipulated that at least 98 percent of the net state tax revenue generated from wagering would be dedicated to property tax relief, while also defining the regulatory structure of sports wagering. Both pieces of legislation passed the Texas House of Representatives but were never referred to committees in the Texas Senate by Lieutenant Governor Dan Patrick (R), thereby ending their legislative prospects.

It is worth noting that State Sen. Lois Kolkhorst (R-Brenham) authored the exact same legislation as Leach in the Texas Senate. Though both were referred to the Senate State Affairs Committee, neither received a public hearing and, as such, were never considered.

Arguments from Supporters

Supporters of legalizing casino gambling—and often sports betting—have presented a range of arguments, focusing primarily on economic benefits, job creation, consumer choice, and modernization. Here are the key points they make:

- Economic Growth and Revenue Generation:

- Proponents argue that legalizing casinos and sports betting would bring significant economic benefits to the state, including increased tourism, job creation, and new sources of tax revenue. They suggest that both casino resorts and sports betting platforms could generate billions in economic activity.

- The revenue generated from these forms of gambling could be allocated to essential public services such as education, healthcare, and infrastructure development, reducing the need for new taxes or budget cuts. Many see legalized gambling as a way to address budget gaps without imposing higher taxes on Texas residents.

- Keeping Revenue in Texas:

- Many Texans already gamble on sports and visit casinos, but they do so out of state. Neighboring states like Louisiana, Oklahoma, and New Mexico have thriving casino and sports betting industries that attract thousands of Texans annually. Supporters argue that legalizing these activities in Texas would keep the revenue within the state’s borders.

- Legalized sports betting would also bring an already widespread activity into the legal sphere. It’s estimated that billions of dollars are wagered illegally on sports annually in Texas, and proponents argue that a regulated market would protect consumers while generating tax revenue.

- Consumer Freedom and Modernization:

- Supporters argue that Texans should have the freedom to choose how they spend their entertainment dollars. Legalizing and regulating casinos and sports betting would provide a safe and controlled environment for these activities, rather than driving them underground or out of state.

- Many also believe Texas should modernize its approach to gambling, aligning itself with other states that have successfully regulated and benefited from both casinos and sports betting. This modernization would not only create new entertainment options but also make Texas more competitive in terms of tourism and hospitality.

- Tourism and Hospitality Growth:

- Casino resorts, combined with sports betting venues, could help turn Texas into a major destination for tourism and entertainment. Resort-style casinos could provide entertainment options beyond gambling, such as concerts, shows, dining, and shopping, boosting the hospitality sector.

- The sports betting market has also proven to be a significant revenue driver in other states. By hosting major sporting events and creating new tourism opportunities around sports wagering, Texas could position itself as a top destination for sports fans and bettors alike.

Arguments from Opponents

Opponents of legalizing casino gambling and sports betting raise concerns about social, economic, and moral implications. Their arguments often revolve around the potential negative effects on communities and vulnerable populations. Here are their main points:

- Social Costs and Addiction Risks:

- Opponents argue that the social costs of legalizing casinos and sports betting—such as increased gambling addiction, crime, and bankruptcy rates—outweigh any potential economic benefits. Studies from other states have shown that proximity to casinos and legal sports betting can lead to higher rates of problem gambling, which can devastate families and communities.

- The financial burden of addressing gambling addiction, including treatment programs and social services, would fall on the state, potentially negating any revenue gains from casinos and sports betting.

- Negative Impact on Local Communities:

- Some worry that casinos and sports betting could negatively impact local communities by fostering environments conducive to crime, including theft, fraud, and money laundering. This could strain local law enforcement and public safety resources.

- Opponents argue that sports betting, in particular, can lead to financial instability for individuals who gamble irresponsibly. Vulnerable groups, such as younger adults, may be more prone to developing gambling addictions.

- Moral and Ethical Concerns:

- Texas has a strong tradition of conservatism, particularly in rural and religious communities, where there are deep-rooted objections to gambling on moral and ethical grounds. For many, both casinos and sports betting are seen as vices that could lead to the deterioration of social values and community well-being.

- Religious and social organizations argue that gambling in any form preys on vulnerable populations, particularly low-income individuals who may see gambling as a way to escape financial hardship, leading to greater economic disparities.

- Uncertain Economic Benefits:

- Some economists and policy analysts caution against overestimating the economic benefits of both casinos and sports betting. They point out that much of the revenue generated by casinos and sports betting would come from local residents, rather than out-of-state tourists, which could lead to a mere redistribution of local spending rather than genuine economic growth.

- Critics also warn that casinos and sports betting may not deliver the promised number of jobs or revenue. In some states, both casino revenue and sports betting profits have plateaued or declined over time, leading to closures and layoffs.

The Current Political Landscape

The debate over legalizing casino gambling in Texas is not just about the merits of the arguments but also about political dynamics. The Texas Legislature, particularly the Republican-controlled House and Senate, has been cautious about expanding gambling, largely due to concerns from conservative constituents and influential interest groups.

Key Political Players:

- Governor Greg Abbott (R) has historically opposed expanded gambling, though he has recently signaled a more open stance, provided that any legislation includes strict regulations and is limited to a few destination resorts. His support could prove pivotal for future legislative efforts.

- Lt. Governor Dan Patrick (R) has been a staunch opponent of casino gambling, citing social costs and potential negative impacts on Texas families. His resistance has been a significant barrier to passing any gambling legislation.

- House Speaker Dade Phelan (R-Beaumont) expressed interest in destination-style casinos at the outset of the 88th Legislative Session and allowed legislation that would have facilitated their implementation to be considered by the Texas House.

The Republican Party of Texas’ 2024 platform opposes any expansion of gambling, including casino gambling and sports betting, which complicates efforts to pass related legislation. Every Statewide elected office and the Texas Legislature has been under Republican-majority control for over two decades.

65. Gambling: We oppose any expansion of gambling, including legalized casino gambling. We oppose and call for a veto of any budget that relies on expansion of legalized casino gambling of any type or size, whether as a standalone business or partnered with any other business or resort, as a method of finance. We call on all Republican legislators to decline campaign contributions from gambling PACs and lobbyists and oppose any effort from the House leadership or members of the House Calendars Committee to pressure members to vote for expanded gambling. We also call for the repeal of the vague “fuzzy animal” exception to Texas’ anti-gambling laws that allow non-cash prizes to be awarded based on the use of eight-liner slot machines.

Additionally, a significant amount of money is being funneled to lawmakers and statewide elected officials in an effort to influence potential legislative action on the issue.

Follow the Money

The debate over legalizing casino gambling and sports betting in Texas is not just about moral arguments, economic benefits, or potential social costs; it’s also a matter of money and political influence. Recent reports have highlighted the significant role that gambling lobbyists and their financial contributions play in shaping the legislative landscape. Understanding how money flows into this debate can provide crucial insights into why the issue of legalizing casinos in Texas continues to resurface and who stands to benefit.

The Role of the Gambling Lobby

Lobbyists representing major casino operators and gambling interests have been increasingly active in Texas politics, funneling substantial amounts of money to key lawmakers and political action committees (PACs). House Speaker Dade Phelan has become a focal point for these contributions. Phelan, who holds a powerful position in determining the legislative agenda, has received a significant influx of cash from gambling interests, positioning him as a potential key supporter of casino legalization efforts.

In the 2024 Primary Election Cycle for instance, Texas Sands PAC doled out nearly $3 million to a plethora of state lawmaker campaign funds. In total, they contributed to nearly 90 incumbent and potentially incoming House lawmaker campaigns (nearly two-thirds of the entire 150-member legislative body) and 20 sitting State Senators of the entire 31-member Senate. In the 2022 election cycle, they contributed over $2.25 million to various elected officials both statewide and in the Texas Legislature.

2024 Top-10 Recipients of Texas Sands PAC Donations

| Candidate | Total Expenditures |

|---|---|

| House Speaker Dade Phelan (R) | $315,000 |

| Lt. Gov. Dan Patrick (R) | $200,000 |

| John Kuempel (R) | $165,000 |

| Frederick Frazier (R) | $129,000 |

| Justin Holland (R) | $129,000 |

| Christian Manuel (D) | $79,000 |

| Ernest Bailes (R) | $79,000 |

| Harold Dutton Jr. (D) | $79,000 |

| Hugh Shine (R) | $79,000 |

| Lacey Hull (R) | $79,000 |

Source: Transparency USA

2022 Top-10 Recipients of Texas Sands PAC Donations

| Candidate | Total Expenditures |

|---|---|

| House Speaker Dade Phelan (R) | $300,000 |

| Lt. Gov. Dan Patrick (R) | $225,000 |

| Gov. Greg Abbott (R) | $200,000 |

| Pete Flores (R) | $64,000 |

| Comptroller Glenn Hegar (R) | $50,000 |

| Kyle Kacal (R) | $43,000 |

| Tan Parker IV (R) | $79,000 |

| Morgan LaMantia (D) | $79,000 |

| Ryan Guillen (R) | $79,000 |

| Alma Allen (D) | $79,000 |

Source: Transparency USA

The Las Vegas Sands Corporation, whose corporate headquarters is in Las Vegas, Nevada, also contributed over $1.4 million in the 2024 election cycle to various entities, including legislative caucuses like those of the Texas House Republican Caucus, the Mexican American Legislative Caucus, the Texas Legislative Black Caucus, and the Texas Legislative Study Group. Their 2024 contributions were increased in comparison to the 2022 election cycle where they donated slightly under $1 million to various legislative and partisan entities, including the Republican Party of Texas, which notably received a $10,000 donation despite having an anti-gambling plank (Plank 79) in their 2022 Platform that read, “We oppose any expansion of gambling, including legalized casino gambling. We oppose and call for a veto of any budget that relies on expansion of legalized gambling as a method of finance.”

2024 Top-10 Recipients of

Las Vegas Sands Corp. Donations

| Committee | Total Expenditures |

|---|---|

| Judicial Fairness PAC | $1 million |

| Texans for Opportunity & Prosperity PAC | $250,000 |

| #PROJECTREDTX | $25,000 |

| 2024 Dallas Bond Campaign | $25,000 |

| Mexican American Legislative Caucus | $25,000 |

| Texas Legislative Black Caucus | $25,000 |

| Texas Republican Legislative Caucus | $20,000 |

| Texas Republican Legislative Caucus | $20,000 |

| Associated Republicans of Texas Campaign Fund | $10,000 |

| Legislative Study Group – Caucus | $10,000 |

Source: Transparency USA

2022 Top-10 Recipients of

Las Vegas Sands Corp. Donations

| Committee | Total Expenditures |

|---|---|

| Judicial Fairness PAC | $750,000 |

| Mexican American Legislative Caucus | $30,000 |

| Mexican American Legislative Caucus | $25,000 |

| Texas Legislative Black Caucus | $25,000 |

| Texas Republican Legislative Caucus | $20,000 |

| Texas Republican Legislative Caucus | $20,000 |

| House Democratic Caucus | $15,000 |

| Texas Democratic Party | $15,000 |

| Legislative Study Group – Caucus | $10,000 |

| Texas Republican Party | $10,000 |

Source: Transparency USA

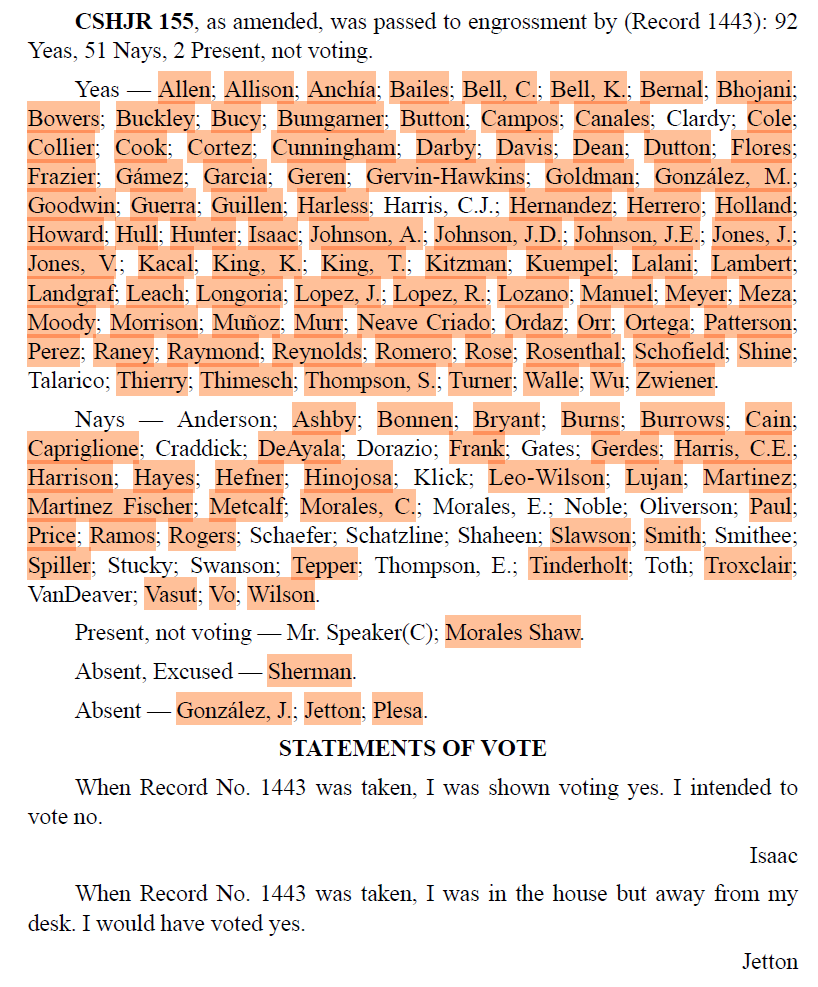

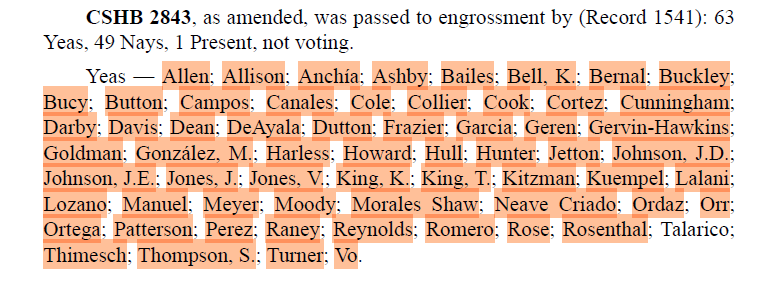

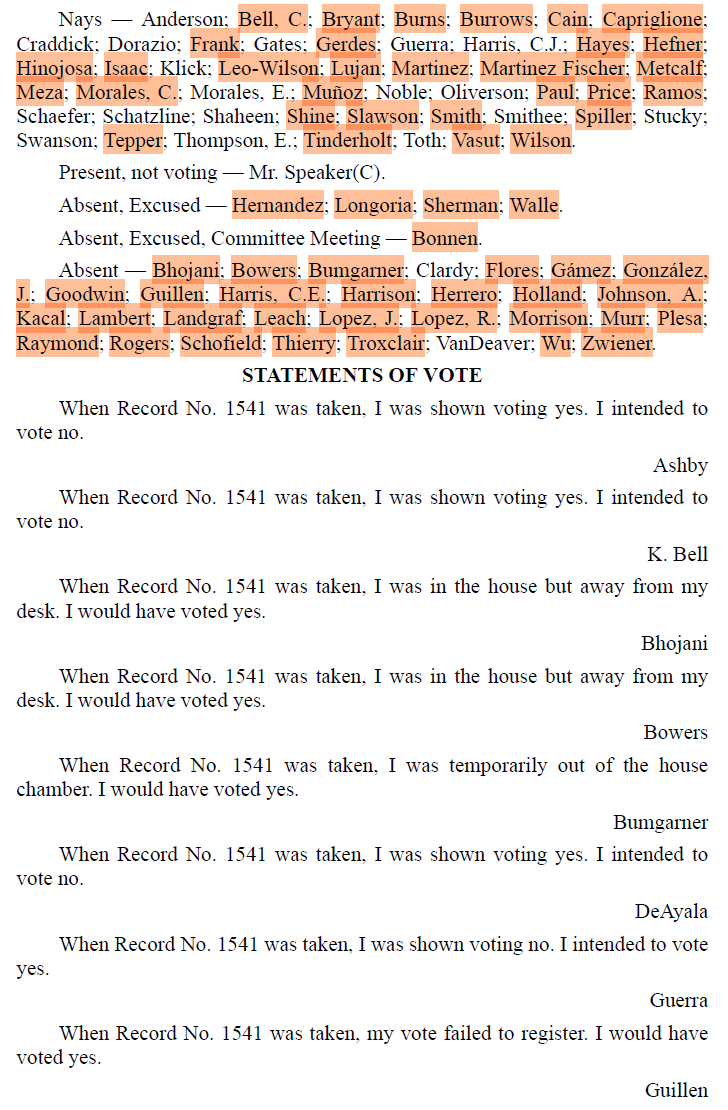

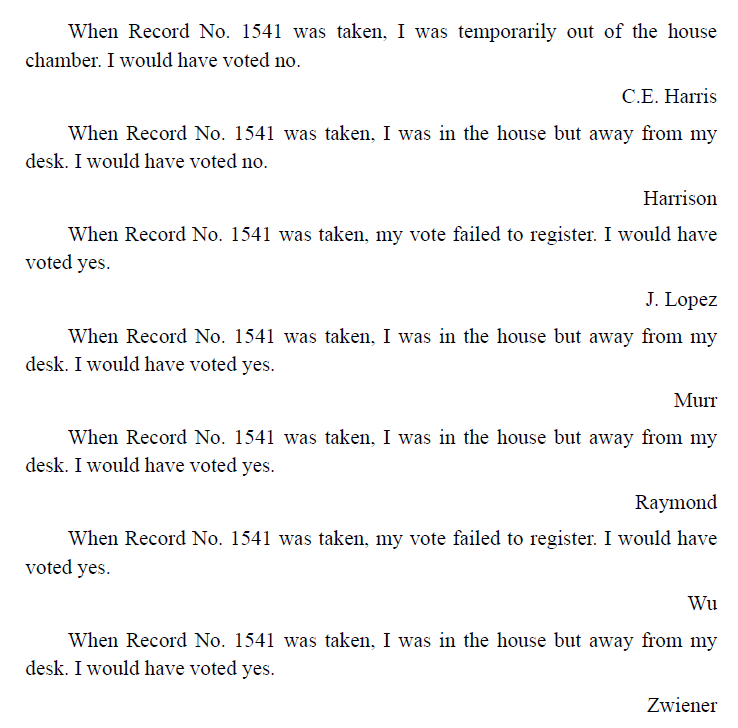

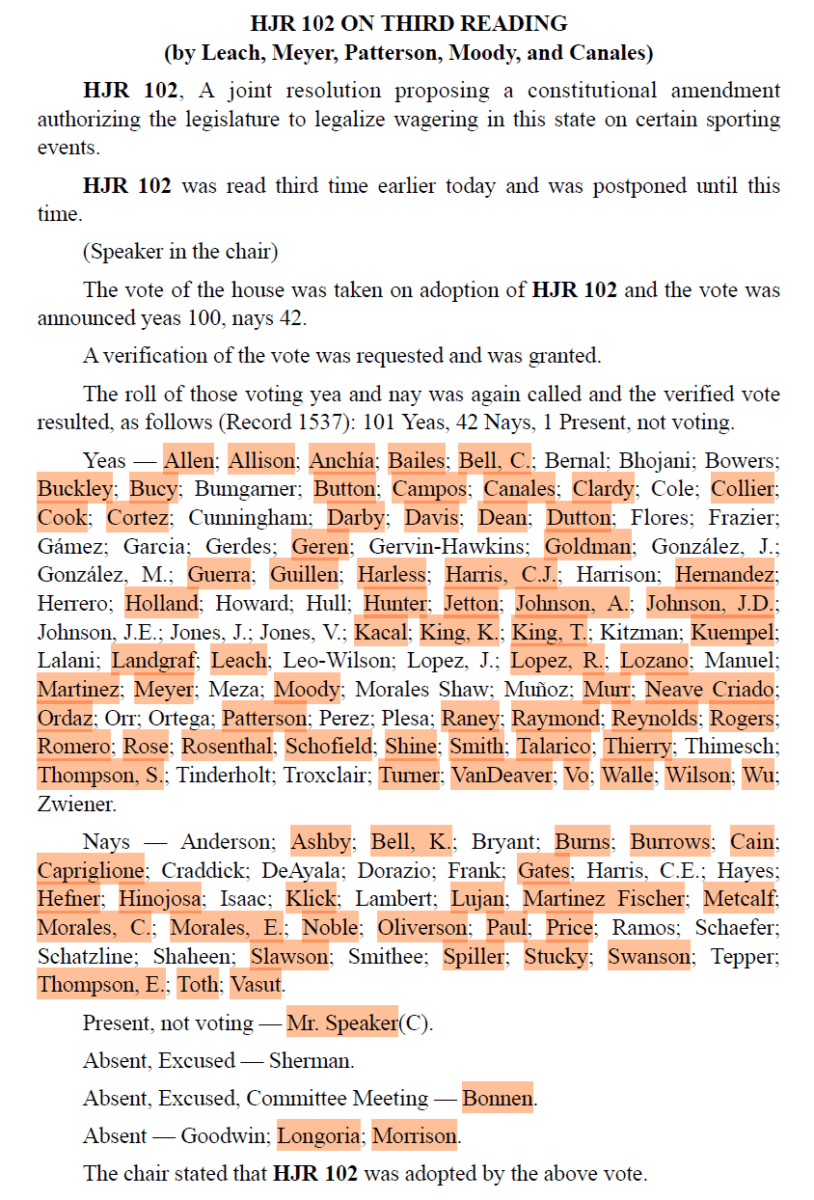

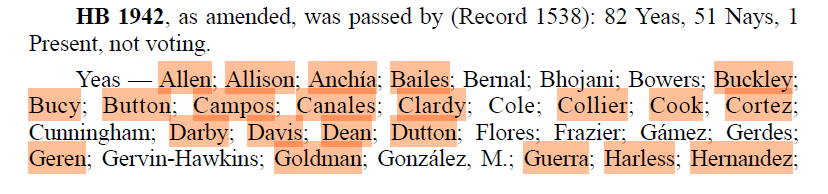

As seen in Figure 1 and Figure 2 below, those highlighted in orange were recipients of donations from the Texas Sands PAC in 2022. In the 88th Legislative Session (2023) House lawmakers considered HJR 155, the proposed constitutional amendment seeking to allow destination casino resorts in select Texas cities. Only three House lawmakers of the ninety-two that initially voted for it did not receive contributions from Texas Sands PAC. Similarly, only one lawmaker of the sixty-three that voted for the enabling legislation, House Bill 2843, which would have established the regulatory framework for the expanded gambling did not receive contributions from Texas Sands PAC, albeit twenty-nine other recipients were initially absent when the vote took place.

Figure 1. Record Vote 1443,

House Joint Resolution 155, Second Reading

Expanded Casino Gambling

Sources: House Journal, 60th Day, May 10, 2023 – Record Vote 1443; Transparency USA

Figure 2. Record Vote 1541,

House Bill 2843, Second Reading

Enabling Legislation & Regulatory Framework

Sources: House Journal, 60th Day, May 10, 2023 – Record Vote 1443; Transparency USA

As mentioned previously, House lawmakers also took on sports betting last legislative session. The Sports Betting Alliance spent over $600,000 in the 2022 election cycle paying an amalgamation of lobbyists and consultants to influence lawmakers. In the 2024 cycle that spending has ramped up to nearly $2 million.

Tilman Fertitta, the owner of the Houston Rockets, an NBA basketball team, struck a $1.6 billion partnership with DraftKings, a sports betting platform, in 2021, with the plan of becoming the exclusive sports betting partner of the Houston Rockets, pending successful legislation enabling such a thing in Texas. In the 2022 election cycle, the Fertittas donated nearly $2 million to various statewide elected officials and lawmakers. Thus far in 2024, they have donated just shy of $825,000. Fertitta was supportive of legislation to bring sports betting to Texas.

2024 Top-10 Recipients of

Tilman Fertitta Donations

| Candidate | Total Expenditures |

|---|---|

| Greg Abbott (R) | $468,750 |

| Dan Patrick (R) | $250,000 |

| Dade Phelan (R) | $10,000 |

| Greg Bonnen (R) | $10,000 |

| Ken King (R) | $10,000 |

| Nathan Johnson (D) | $10,000 |

| Joan Huffman (R) | $7,500 |

| Charles Geren (R) | $5,000 |

| Dustin Burrows (R) | $5,000 |

| John Kuempel (R) | $5,000 |

Source: Transparency USA

2022 Top-10 Recipients of

Tilman Fertitta Donations

| Candidate | Total Expenditures |

|---|---|

| Greg Abbott (R) | $915,575 |

| Dan Patrick (R) | $300,000 |

| Dade Phelan (R) | $110,000 |

| Glenn Hegar (R) | $45,000 |

| Ken Paxton (R) | $40,000 |

| John Whitmire (D) | $25,000 |

| Joan Huffman (R) | $19,083 |

| Greg Bonnen (R) | $10,583 |

| Brandon Creighton (R) | $10,000 |

| Bryan Hughes (R) | $10,000 |

Source: Transparency USA

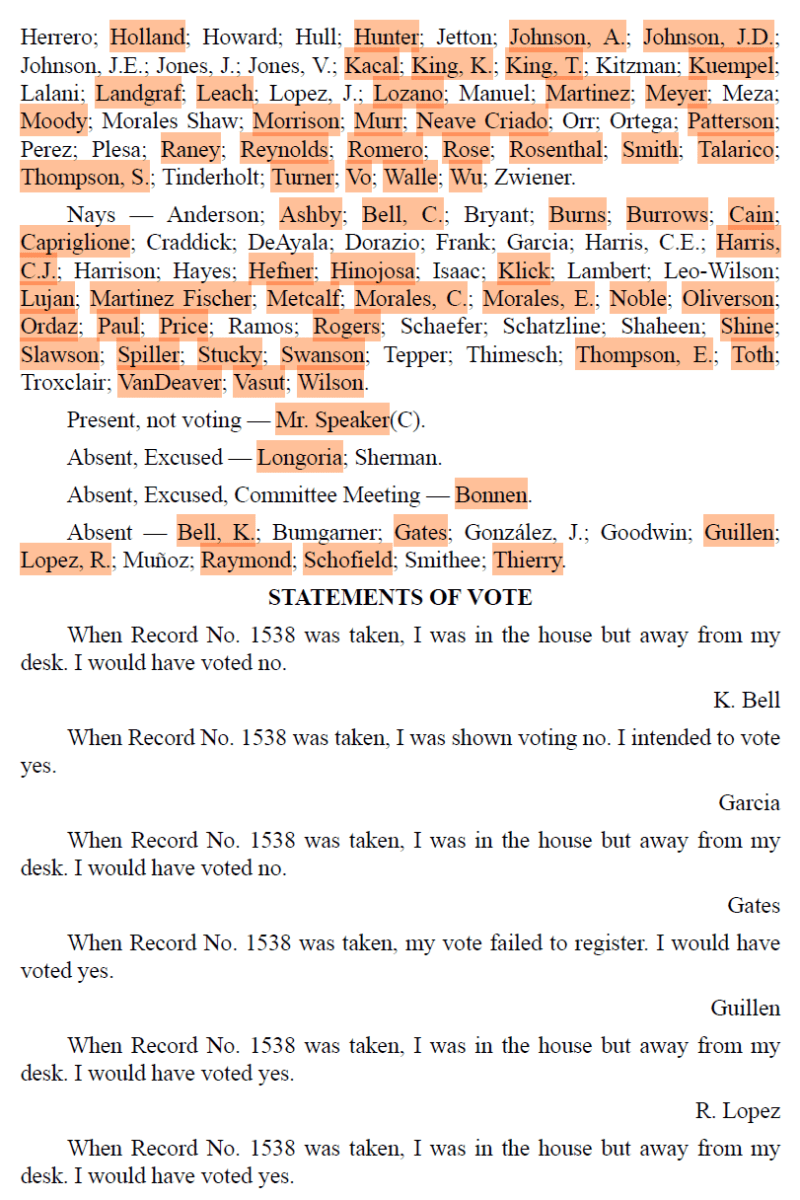

As seen in Figure 3 and Figure 4 below, those highlighted in orange were recipients of donations from Tilman Fertitta in 2022. In the 88th Legislative Session (2023) House lawmakers considered HJR 102, the proposed constitutional amendment seeking to allow sports betting. Sixty-four House lawmakers of the one hundred and one that initially voted for it received contributions from Tilman Fertitta. Similarly, fifty-two of the eighty-two lawmakers that voted for the enabling legislation, House Bill 1942, received contributions from Tilman Fertitta, which would have established the regulatory framework for sports betting. Both pieces of legislation passed the Texas House but were never considered by the Texas Senate.

Figure 3. Record Vote 1537,

House Joint Resolution 102, Third Reading

Sports Betting

Sources: House Journal, 60th Day, May 10, 2023 – Record Vote 1443; Transparency USA

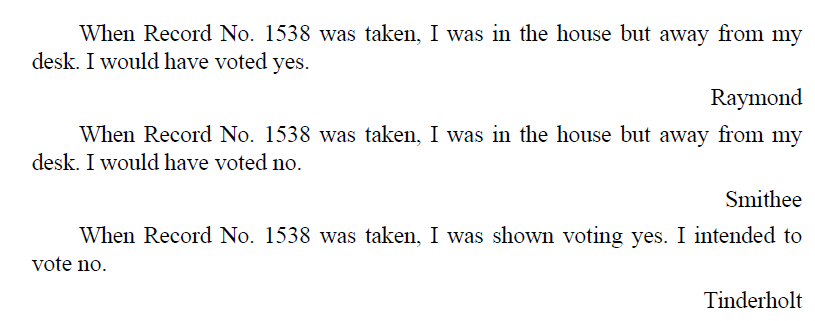

Figure 4. Record Vote 1538,

House Bill 1942, Third Reading

Enabling Legislation & Regulatory Framework

Sources: House Journal, 60th Day, May 10, 2023 – Record Vote 1443; Transparency USA

Looking Ahead: What’s Next for Casino Gambling & Sports Betting in Texas?

The future of both casino gambling and sports betting in Texas remains uncertain. While the recent legislative efforts failed to pass, the debate is far from over. Proponents are likely to continue pushing for reform in the upcoming 89th Legislative Session, or through a statewide referendum that could let voters decide directly.

Key factors to watch include:

- Public Opinion: Polls show that public opinion in Texas is gradually shifting, with a growing number of Texans expressing support for casino gambling, especially if it could help fund critical state services. This shift may encourage lawmakers to revisit the issue.

- Economic Pressure: As Texas continues to seek new revenue sources to support a growing population and infrastructure needs, the economic argument for casinos may become more persuasive.

- Strategic Compromises: Future legislative efforts might focus on more limited proposals, such as allowing only a small number of high-end destination resorts with strict regulations. Such compromises could help win over some skeptics while still achieving proponents’ goals.

Conclusion

The battle to legalize casino gambling and sports betting in Texas encapsulates a broader conflict between economic interests, social values, and political realities. While the potential economic benefits are enticing for some, the social costs and moral objections remain significant hurdles. As Texas continues to evolve, so too will the debate over its gambling laws. For now, the question remains: Will the Lone Star State roll the dice on casino gambling, or will it continue to resist the pressure to expand?

Texas Policy Research relies on the support of generous donors across Texas.

If you found this information helpful, please consider supporting our efforts! Thank you!