Estimated Time to Read: 6 minutes

The Texas Legislature made significant promises about providing property tax relief during the 88th Legislative Session in 2023. However, an analysis of updated property tax numbers from the Texas Comptroller reveals that those promises have fallen short. The new data demonstrates that property tax levies in Texas continue to rise, leaving taxpayers to shoulder an increasing financial burden.

A Historical Look at Property Taxes in Texas

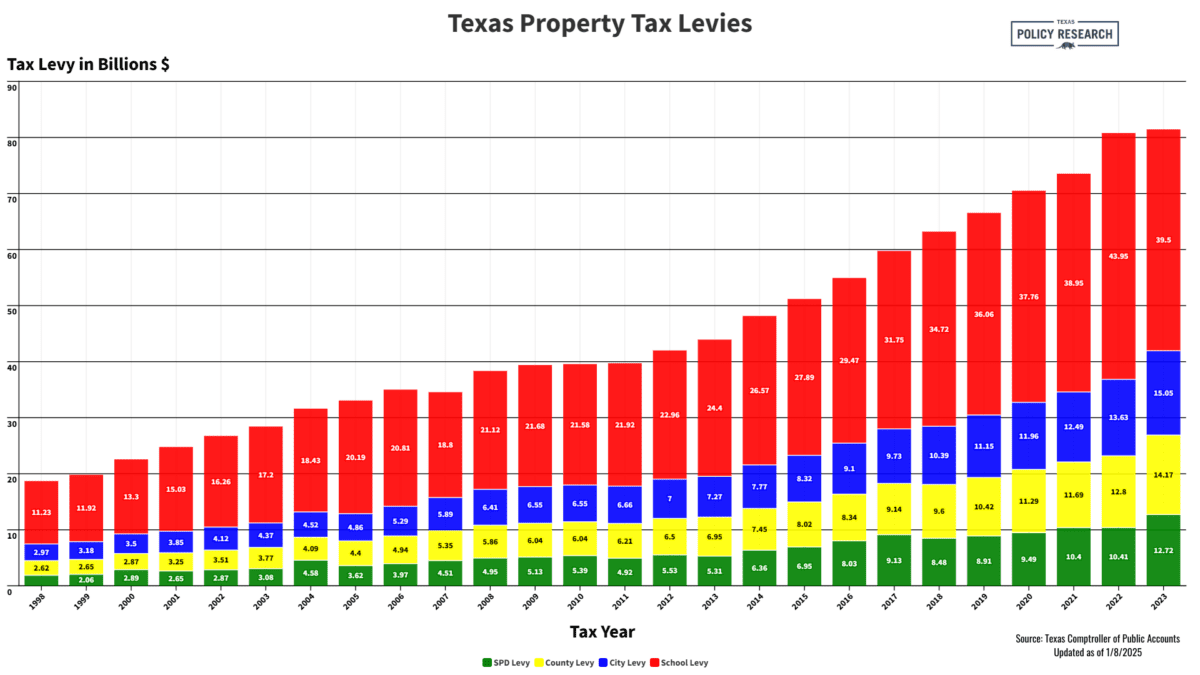

The trajectory of property tax levies in Texas from 1998 to 2023 shows staggering growth. During this period, total property tax levies grew from approximately $20.81 billion in 1998 to an eye-popping $80.44 billion in 2023. These levies include contributions from school districts, cities, counties, and special purpose districts (SPDs). School district levies alone have risen from $11.23 billion in 1998 to $39.5 billion in 2023, making them the largest contributor to this surge. Despite legislative measures claiming to address the issue, school taxes remain the primary driver of rising levies.

County and city property taxes have also skyrocketed. County levies increased from $2.62 billion to $15.05 billion over the same period, while city levies grew from $2.97 billion to $14.17 billion. Even SPDs, though smaller in share, saw growth from $2.06 billion in 1998 to $12.72 billion in 2023. Alarmingly, the total property tax levy jumped by nearly $4 billion from 2022 to 2023 alone, showing no signs of slowing despite legislative promises of relief.

What Did the 88th Legislature (2023) Promise?

After much debate during the regular and special sessions, lawmakers passed legislation, which they touted as “historic” property tax relief measures. These bills aimed to increase the homestead exemption, cap appraisal growth rates, and compress school district tax rates. Specifically, the measures:

- Raised the homestead exemption from $40,000 to $100,000 for school district taxes

- Capped annual property value appraisal growth at 10% for residential and commercial properties.

- Allocated state surplus funds to “buy down” school district maintenance and operations (M&O) tax rates.

Lawmakers claimed these changes would provide the largest property tax cut in Texas history. However, updated Comptroller data contradicts these claims, showing that the property tax burden actually increased.

Dr. Vance Ginn, a Texas Policy Research board member and President of Ginn Economic Consulting, noted,

“Latest [Comptroller] biennial property tax report published in December 2024 shows that property taxes indeed increased in 2023 even after the Legislature’s relief efforts last session. This makes the “relief” now the fourth best since 1998, with 2007 (only decline), 2010, and 2011 being percent changes lower than the 0.81% increase in 2023.”

“Regardless, Texas must cut spending, impose strict state and local spending limits thereafter, cap any property tax increase with voter approval, and use all surplus to reduce tax rates. Moreover, this should end the discussion about bad ideas of raising the homestead exemption, keeping loopholes in caps, and spending more hard-earned taxpayer money.”Source: Vance Ginn, Ph.D., Twitter/X Post 1.8.2025

Why Didn’t the Promised Property Tax Relief Work?

The updated numbers reveal that property taxes continue to rise for several reasons. First, booming real estate markets have caused property values to skyrocket, and appraisal caps alone cannot offset this growth. High appraisals directly lead to higher tax levies, neutralizing the intended benefits of rate compression and exemptions. Additionally, many local governments, including cities and counties, have raised their tax rates, exacerbating the problem.

The increased homestead exemption provides only limited relief. While homeowners see a modest reduction in taxable value, businesses, renters, and owners of second homes gain nothing from the exemption. Furthermore, special purpose districts with independent taxing authority continue to expand, adding yet another layer to the property tax burden. Without meaningful oversight, these entities often operate unchecked.

Texas Property Tax Relief: Why Current Efforts Fall Short

The current approach to property tax relief focuses on addressing symptoms rather than root causes. Temporary fixes like appraisal caps and exemptions cannot keep pace with rising property values or the financial demands of local governments. Lawmakers had the opportunity to provide lasting relief during the 88th Session, backed by a historic budget surplus, but instead chose to fund the largest spending increase in Texas history. By doing so, they missed the chance to fundamentally reform Texas’ tax system.

The issue lies not in revenue but in spending. Property taxes have become the primary revenue source for local governments, fueling a system where taxpayers are perpetually burdened by increasing costs. This unchecked spending has created an affordability crisis. Homeowners face escalating tax bills, renters bear higher rents as landlords pass on their tax burdens, and small businesses struggle to survive under the weight of rising levies.

Conclusion

The updated property tax numbers from the Texas Comptroller reveal a harsh reality: the relief promised during the 88th Legislative Session was ineffective. Property tax levies have continued to rise, leaving Texans without meaningful relief. With the 89th Legislative Session just a week away, lawmakers have another chance to act. Once again, a significant budget surplus offers an opportunity to implement bold reforms. Texans deserve better than temporary fixes. It’s time to address the root causes of the property tax crisis and deliver real, lasting relief for homeowners, renters, and businesses alike. The question remains: will lawmakers seize this opportunity, or will Texans be left waiting yet again?

Texas Policy Research relies on the support of generous donors across Texas.

If you found this information helpful, please consider supporting our efforts! Thank you!